Capital Credits

Benefits that pay off, big time.

What makes a co-op like ours different from your typical electricity provider is that you, a member, are part owner. So when we’re successful, it pays off for everyone!

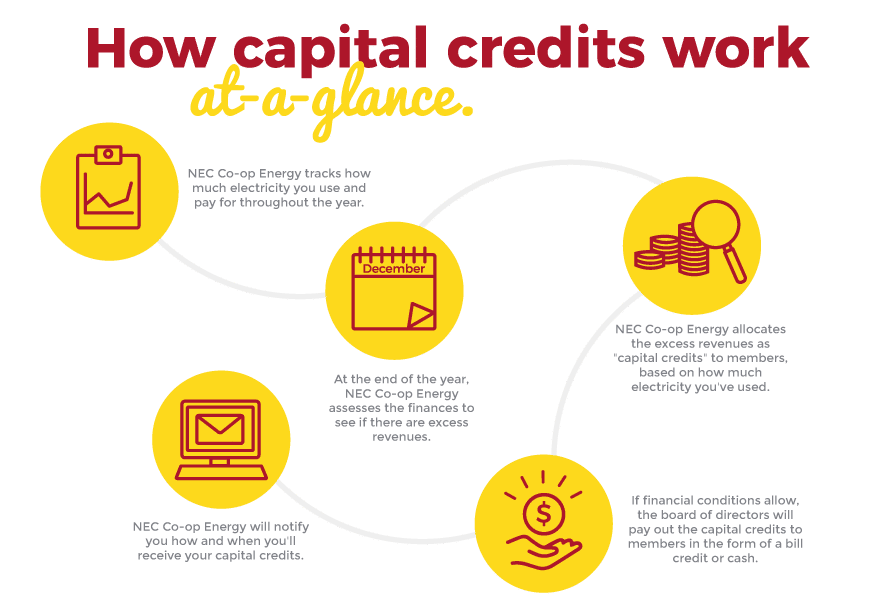

Capital Credits represent your allocated share of the cooperative’s margins during your membership. Your credits are based on how much energy you purchase during the year, and the gross margins by those purchases.

At the end of each fiscal year, the profits are allocated proportionately back to members’ accounts, until they’re retired (paid) back to you.

View a sample Capital Credit statement

Frequently Asked Questions

- Allocations: Each year, you are “allocated” your portion of the previous year’s margin based on the amount of electricity you purchased from NEC Co-op Energy in relation to the total amount of electricity purchased by all members during the year. This amount is put into a “holding account” for a number of years and used by NEC Co-op Energy to fund capital needs related to your service. This is an underlying principle of the cooperative business model and is one more way we keep your electric rates as low as possible. This “allocation” becomes your equity in the cooperative and is maintained in a separate account assigned to you. View a sample allocation (PDF) statement online.

- Retirement: This is what you will get in cash at a later date. NEC Co-op Energy uses the amount “allocated” to you for a time, but then returns this amount to members in the form of “retirements,” which are actual “cash back” dollars to you.

Eventually, if NEC Co-op Energy cannot return the funds to the member, NEC Co-op Energy must give these “escheated” capital credits to the state comptroller.

- Receive detailed instructions letter

- Complete Release & Waiver for deceased member

- Gather certified copies of supporting documents below

- Death Certificate, and

- One of the following:

- Testamentary

- Order admitting will to probate

- Small estate affidavit

- Return completed and notarized waiver, along with supporting documentation, to: Nueces Electric Cooperative, Attn: Capital Credits Clerk, PO Box 260970, Corpus Christi, TX 78426

If you wish to have NEC Co-op Energy personnel notarize the release (free), please call ahead to ensure that a notary public will be available. The completed Release and Waiver and a copy of the death certificate are needed to complete the capital credit transfer or estate retirement.

Additionally, each member’s un-retired capital credit balance can be viewed online using NEC Co-op Energy’s ebill system, a secure web site that allows members to view current and historical bills, pay a bill, change an address, and many other features. If you are not currently signed up for ebill, signup online today.

About Resources

Real Pricing for Real People

"NEC Co-op Energy is different than your typical provider, especially with the reward programs that give me extra cash at the end of the year."

Alex

Learn More

"We don’t really trust the gimmicks from other providers. We know how much our rate will be on our bill, and it usually ends up being lower than everyone else."

Analisa

Learn More

"They give us their best. That’s how I work, that’s how NEC works, and so it just makes good sense."

Dale & Nita

Learn More

"We’ve been members 40 years and we’re not going anywhere. That ought to tell you something."

David

Learn More

"My whole family uses NEC Co-op Energy. We've been members since the co-op started back in 1962! That should say something."

Dennis

Learn More

"With NEC, as a member, you get a return on your investment. No regular electricity company does that."

Dick

Learn More

"We like NEC Co-op Energy because of the benefits: the bonus payments, our Veteran credit and a lower bill in December. Oh, and we love the annual barbecue!"

Jerry & Eva

Learn More

"With NEC Co-op Energy, I'm a member. I'm not just another number. And my bill really is lower than the other providers out there!"

Kay

Learn More

"I've worked for a utility company. I know what to look for to find the best deals. And NEC Co-op Energy really is the best deal."

Kendra

Learn More

"All the profits come back to the customers, and we get PowerPerks, which means we can get a discount or even a free bill in December!"

Megan

Learn More

"We like the Power Perks at the end of the year, it really helps with Christmas time."

Michael & Lisa

Learn More

"Their service is prompt, and I get to talk to people right away, not a recording. I've always had great customer service."

Robert

Learn More

"Being a co-op, they’re not out for profit, they’re out for service. I wouldn’t recommend anyone else."

Robin

Learn More

"I like supporting a non-profit. It feels good knowing my money is going back to the members, not a giant corporation."

Sara

Learn More

"I like that there are no contracts. I’m busy managing over 300 properties, I don’t have time to deal with that."

Veronica

Learn More

"They're like a family. I rely on them to power my businesses and my home, and we've always had great service."

Wayne

Learn More

"If I need anything, I can just pick up the phone, call them and they're available for me. We know each other's first names!"

Whitney

Learn More